Posted On: February 15, 2024 by Prevail Bank in: Banking / Money Management

Improve your financial health. Save money - automatically.

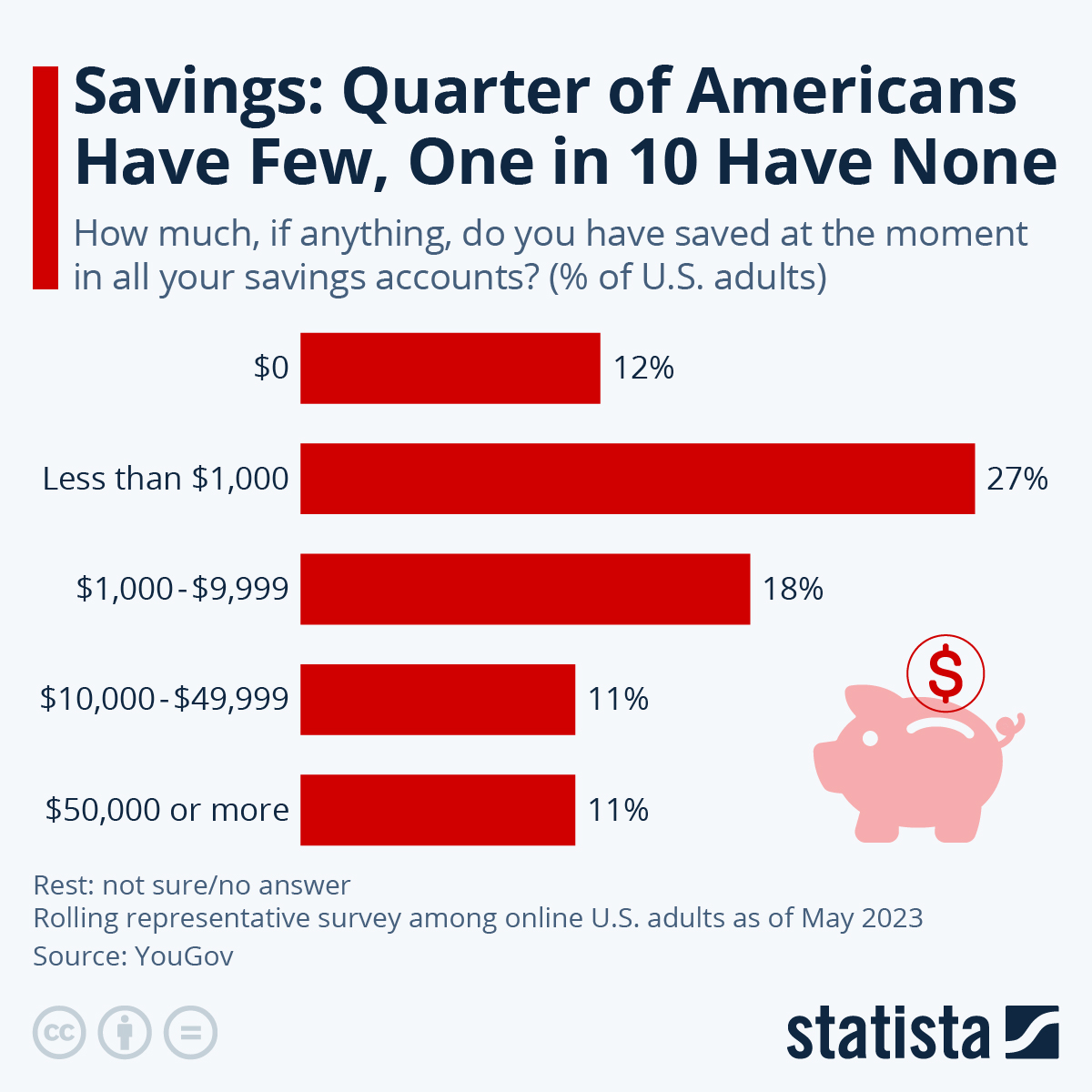

According to a rolling representative online survey of US adults by YouGov, 12% of Americans have no savings at all; 27% have some savings, but it totals less than $1,000. Some is better than none – right?! Times are tough. How can a person build a savings account when they’re already living paycheck-to-paycheck? The magic of auto-transfer might be the answer.

What is an automated transfer of funds?

An automated transfer of funds is an action that is established between you and your financial institution. You arrange to have funds transferred from one of your accounts to another on a regular, periodic basis. It’s a ‘set it and forget it’ program. Almost all banks, investment companies, and other financial institutions offer automatic transfer services to their customers. People use them to make payments, save money, and to contribute to a retirement or emergency fund.

Image Source (1-2024):https://www.statista.com/chart/20323/americans-lack-savings/

What can you save through automatic transfers?

If you transfer a small amount on a regular basis – say the day after payday - you could build yourself a savings account - automatically. The trick is to identify an amount that you won’t notice, and this will vary based on your circumstances, but even $10 transferred on the 1st and 15th of every month adds up. That’s $240 in a year without interest. If you auto transfer $50 twice a month, you’d have a savings account for emergencies totaling $1,200 at the end of the year (more if the account earned interest). But don’t touch it unless it’s an emergency! Let it ride!

How much should you have in a savings account?

The rule of thumb is to have at least 3 to 6 months’ worth of expenses saved in an emergency fund. Those expenses would be your rent, utilities, food, car payment, insurance, and gas, etc. If something happens to your employment, the emergency fund has you covered for a little while. Other emergencies might be an auto mechanic bill or a surprise medical bill - who plans on the car breaking down or getting sick? The point is an emergency fund is a good reason to establish an automatic transfer of funds. Identify ways to spend less money so you can boost the size of those automatic deposits. No dollar amount is too small.

What are other options for saving money – automatically?

Some financial institutions/banks have what is called a Round-Up Savings Program. It allows you to automatically round up your debit card purchases to the nearest dollar amount. The difference between the actual purchase price and the round-up amount is then transferred to your savings account – automatically.

Prevail Bank – Saving Makes Cents

Saving Makes Cents is Prevail Bank’s round-up program. Customers with a Prevail Bank checking account, savings account, and debit card can save money while making regular purchases. This program rounds-up your purchase to the next whole dollar and transfers the change to your savings account. It’s free --- get this established today! Visit or call a Preval Bank banker /teller.

If your employer offers direct deposit for your paychecks, consider splitting a portion of your paycheck directly into a savings account before the funds hit your main checking account. You can typically designate a specified percentage or defined amount to be allocated for each direct deposit. For example, if your paycheck is $1500, you could designate 3% ($45) to be automatically transferred into a savings account; 10% would be $150. Could you teach yourself to live on $1,350 every two weeks instead of $1,500?

And by-golly, deposit any bonuses into your savings account.

What are you making for interest on your checking account balances?

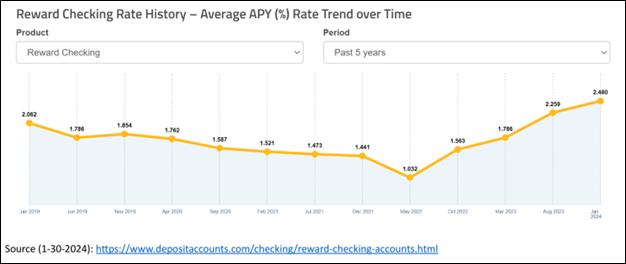

According to DepositAccounts, high-yield interest reward checking account rates are at a 5-year high based on their analysis of 1,023 banks and credit unions. The average APY* (annual percentage yield) for a rewards checking account was 2.48% in January 2024.

So, if we do a little calculating using CalculatorSoup.com: If interest is compounded annually, this equates to $245 in earnings on a $10,000 deposit left untouched for that year. If interest is compounded monthly, you would gain $247.77 if left untouched for a year. How interest is compounded makes a difference too; it all adds up eventually.

* APY rates are subject to change.

So yes, some checking accounts – interest rewards checking accounts - offer the means to make/earn money. It isn’t necessarily a savings, but it is money you wouldn’t otherwise have. Is your checking account earning interest?

There are typically monthly requirements tied to Interest Rewards Checking accounts; · 10 to 20 debit card purchases, · at least one direct deposit, and the · acceptance of electronic statements. As such, it isn’t an option for everyone.

Prevail Bank’s Premium Interest Checking account calculates interest monthly – automatically and has a low account opening deposit of $50. Check out the details and current interest rate now!

If you want to make the switch to Prevail Bank, consider ClickSWITCH. It can move your accounts and direct deposits to Prevail Bank quickly, easily, and securely.

Bottom line. Should you automate your savings?

Ask any financial planner how they would go about building wealth, and automating your savings almost always makes the list. Automating savings also establishes good financial habits.

Get off on the right foot. Establish yourself with an automatic transfer of funds, direct deposit split, and/or a round-up savings program. For more information, contact a Prevail Bank banker.