Posted On: September 10, 2024 by Prevail Bank in: Home Loans

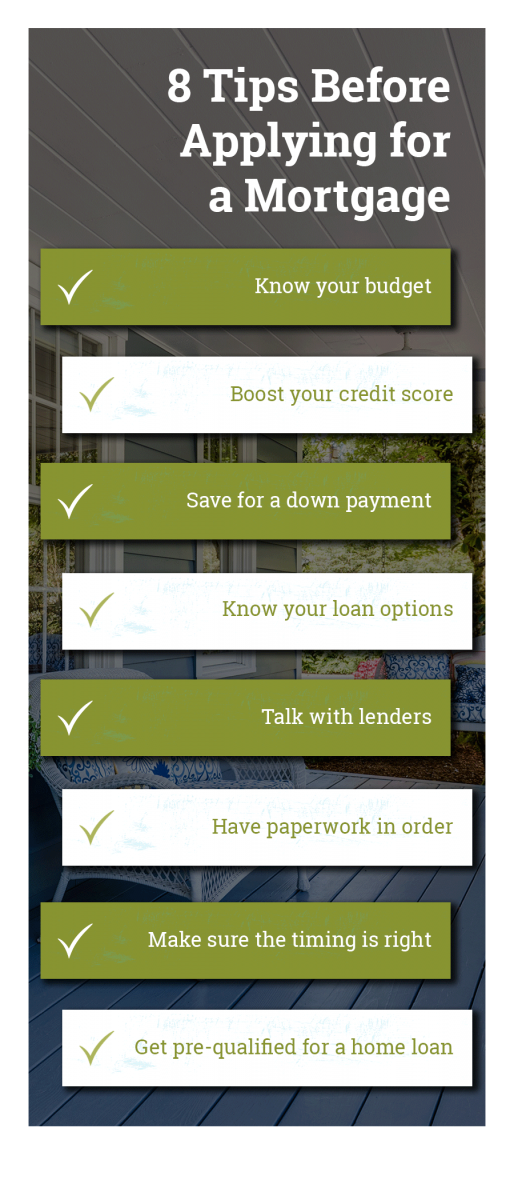

A lot goes into applying for a mortgage and deciding whether it is the right time for you. From knowing your budget, researching home loan programs, getting ahead on your debt, increasing your savings, and becoming pre-qualified. All are helpful in making the home buying process successful from start to finish.

Prevail Bank Mortgage Loan Originators Tina Dassow, NMLS# 2156923, and Lana Peterson, NMLS# 1236394, offer you helpful tips to help you make the best decisions in your home buying process.

Know your budget.

- In general, mortgage lenders prefer your income to debt ratio (which includes housing expenses and long-term debt) not to be higher than 45% of your monthly gross income.

- We offer several mortgage calculators to help make budgeting easy and convenient!

Boost your credit score.

- Increase credit limits. Credit utilization is an important factor. You may be approved to charge a large amount of money on your credit card, but ironically, for a better credit score they want you to utilize 30% or less of the amount you were approved for. That’s less than half! So, if you find yourself charging more than that amount, asking for an increase in your limit will help you.

- Reducing your debt will free up money for your mortgage payments and other housing expenses.

- Keeping your payments current will also help. Credit reports will show any late payments, judgments, and collections. These will hurt your credit score and can be the basis for denial of your home loan request.

Save for a down payment.

- Loan programs will require verification of down payment funds. And as a good rule of thumb, you should have a cushion to cover 2-months of mortgage payments, taxes, and insurance.

- The targeted down payment amount is typically 20% of the home’s purchase price. Having a larger down payment will reduce your monthly payment.

- A down payment isn’t the only cash you’ll need when you close on a home. Loan closing costs average 3-4% of your home’s purchase price.

Know your loan options.

- What down payment options are available?

- Length of the loan term. What's the right mortgage length for you?

- What is the difference between fixed or variable interest rates? Which is better for you?

Talk to lenders.

- The right mortgage lender is helpful in a loan transaction as well. Maintaining constant communication with your lender proves beneficial during the loan process. You also want to choose a lender who is knowledgeable about the products they offer and can serve as an “advisor” during the loan process.

- Ultimately, find the right lender and real estate agent that you are comfortable working with to purchase your dream house.

Have paperwork in order.

- Some examples of documentation you will need to apply for a home loan are W-2’s, paystubs, bank statements, retirement/investment statements, tax returns, etc.

Get pre-qualified for a home loan.

- Get ahead of the game by having your credit and income reviewed. Being pre-qualified will show the real estate agent that you’re a serious and qualified buyer. Most pre-qualifications are good for 3-4 months, which will allow you time to shop for the perfect home.

- Choose a mortgage loan originator and apply online. Be one step closer to being pre-qualified today!

Buying a home is an important decision, so it’s beneficial not to rush the process. These helpful tips will help make it easier to choose the right mortgage loan for you!

Speak with a Prevail Bank Mortgage Loan Originator today.

Meet the lenders

Lana Peterson (NMLS# 1236394)

*Serving our Marshfield location.

For over 20 years, Lana has been part of the Prevail Bank team. “The lending department has been my happy place since 2009, where I started as a loan processor. I learned a lot in that role but wanted more customer interaction,” stated Lana. In 2014, Lana took on the role of a Mortgage Loan Originator and hasn’t looked back since! “I am grateful for the friendships formed and the community awareness my role has given me. Marshfield has a great support network and being part of that has been a joy. Whether it’s supporting a fundraiser or volunteering time, it’s great to see all of us working together!” Contact Lana

For over 20 years, Lana has been part of the Prevail Bank team. “The lending department has been my happy place since 2009, where I started as a loan processor. I learned a lot in that role but wanted more customer interaction,” stated Lana. In 2014, Lana took on the role of a Mortgage Loan Originator and hasn’t looked back since! “I am grateful for the friendships formed and the community awareness my role has given me. Marshfield has a great support network and being part of that has been a joy. Whether it’s supporting a fundraiser or volunteering time, it’s great to see all of us working together!” Contact Lana

Tina Dassow (NMLS# 2156923)

*Serving our Medford and Phillips locations.

Tina has over 10 years of experience in insurance and mortgage services. She has over 20 years of experience in customer service and previously served as Prevail Bank’s Lead Mortgage Loan Assistant. For Tina, the most rewarding aspect of mortgage lending is working with people and helping them achieve their home goals. Outside of work Tina enjoys being active in the Medford Youth Soccer Association, Girl Scouts, and Saint Paul’s Lutheran Church where she is the treasurer. Get in touch with Tina for your home lending needs.

Tina has over 10 years of experience in insurance and mortgage services. She has over 20 years of experience in customer service and previously served as Prevail Bank’s Lead Mortgage Loan Assistant. For Tina, the most rewarding aspect of mortgage lending is working with people and helping them achieve their home goals. Outside of work Tina enjoys being active in the Medford Youth Soccer Association, Girl Scouts, and Saint Paul’s Lutheran Church where she is the treasurer. Get in touch with Tina for your home lending needs.